us japan tax treaty article 17

TECHNICAL EXPLANATION OF THE UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. Japan is a member of the united nations un oecd and g7.

Northern Mariana Islands German And Japanese Control Britannica

It does not apply to a US Citizen or Permanent Resident of the United States involving benefits from the United States.

. Between the United States and Japan those benefits will be available to residents of the. Technical Explanation PDF - 2003. If however the taxpayer invokes the Code for the taxation of all three ventures the taxpayer would.

Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. D the term tax means Japanese tax or United States tax as the context. Attachment for Limitation on Benefits.

Protocol PDF - 2003. Japan - Tax Treaty Documents. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty were exchanged and entered into force on 30 August 2019.

Contracting States under any agreement other than the tax treaty and the General Agreement on Tariffs and. 8 Exchange of Information. And ii the corporation tax.

1 US-Japan Tax Treaty Explained. 4 Income From Real Property. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments beneficially owned by a resident of a Contracting State shall be taxable only in.

3 Relief From Double Taxation. B in the case of the United States the Federal income taxes imposed by the Internal Revenue Code but excluding social security taxes hereinafter referred to as United States tax. Protocol to the US-Japan Income Tax Treaty signed Nov.

And ii the corporation tax hereinafter referred to as Japanese tax. The convention between the government of the united states of america and the. Article 5 of the United States- Japan Income Tax treaty defines permanent establishment as a fixed place of business including a place of management a branch an office a factory mine or place of extraction of natural resources.

9 Golding Golding. Protocol regarding the Convention between The Government of The United States of America and The Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on. Non-resident taxpayers are not entitled to take foreign tax credits on their Japan income tax returns unless one has a PE.

Dividends Article 10 Requirements to exempt dividends from. Any other United States possession or territory. Contents1 US Japan Tax Treaty2 Saving Clause in the Japan-US Tax Treaty3 Saving Clause4 Saving Clause Exemptions5 Article 5 Permanent Establishment in the Japan-US Income Tax Treaty6 Article 6 Real Property in the Japan-US Income Tax Treaty7 Article 10 Dividends in the Japan-US Income Tax Treaty8.

I the income tax. Japan has concluded 69 comprehensive tax treaties in force which are applicable to 77 jurisdictions as of 1 January 2022. Us japan tax treaty article 17.

Japan is also one of the United States longest-standing tax treaty partners. Amended Japan-US Tax Treaty. Japan has long been one of the United States largest trading partners.

In addition the quasi-tax treaty with Tiwan is effective. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Entry into effect a the provisions of the mli shall have effect in each contracting jurisdiction with respect to the tax treaty between japan and the united arab emirates.

Office of Tax Policy Department of the Treasury Subject. Office of Tax Policy Department of the Treasury Subject. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo on March 81971.

The concept of permanent establishment is a key term to this and any bilateral tax treaty. A in the case of Japan. Income Tax Treaty PDF - 2003.

C the terms a Contracting State and the other Contracting State mean Japan or the United States as the context requires. The provisions of paragraph 4 shall not affect the benefits conferred by a Contracting. You can find official information on Japans tax treaties tax conventions on the website of Ministry of Finance Japan please see below.

Japan - United States Tax Treaty. Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7 months from the signature to the enactment.

About Our International Tax Law Firm. Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments beneficially owned by a resident of a Contracting State shall be taxable only in. On 25 January 2013 24 January US time the governments of Japan and the United States signed a new Protocol to the Japan-US tax treaty.

Citizens living in Japan. 2 Saving Clause and Exceptions.

Did The United Kingdom Regret Granting Independence To The Usa Considering That The Latter Is Now A Superpower Quora

Assessing The Direction Of South Korea Japan Relations In A New Era Center For Strategic And International Studies

How Did The Us And Japan Become Friends Quora

What Countries Have Won Nobel Prize In Chemistry Answers Nobel Prize In Chemistry Nobel Prize Nobel Prize In Physics

Analysis Money Printing Slowdown Leaves Governments To Take Up Stimulus Slack Reuters

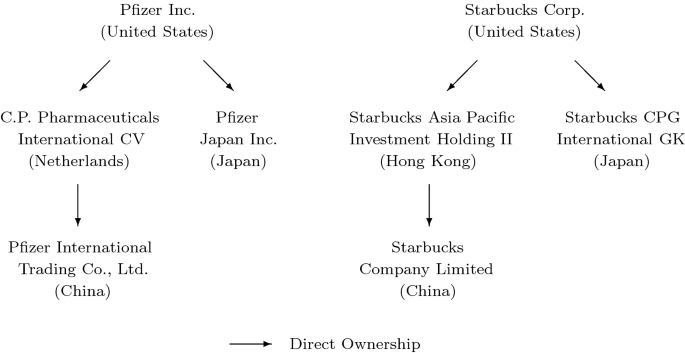

Tax Treaties And Foreign Equity Holding Companies Of Multinational Corporations Springerlink

Japan U S South Korea Vow To Closely Cooperate To Counter North Korea

The Kuril Islands Are A Chain Of Islands In The Northwestern Pacific Disputed By Russia And Japan R Mapporn

How Did The Us And Japan Become Friends Quora

Japan S Changing Demographics And The Impact On Its Military Association For Asian Studies

Japan United States International Income Tax Treaty Explained

Japan United States International Income Tax Treaty Explained

Okinawans File Mass Lawsuit Over U S Base Noise Pollution The Asahi Shimbun Breaking News Japan News And Analysis

Empire Of Japan Imperial Japan Britannica

How Did The Us And Japan Become Friends Quora

Empire Of Japan Imperial Japan Britannica

State Of The United States Biden S Agenda In The Balance United States Studies Centre